Powering the Future of Personalized Advice

We help advisory firms and enterprise platforms deliver scalable, goals-based portfolios using your models and real client goals. Strengthen advice. Tell a better story. Deliver what matters most.

What Sets Us Apart and Elevates Your Advice

Goals-Driven

Portfolio Construction

Say goodbye to generic model portfolios based on simple risk scores and deliver personalized, goal-driven asset allocation tailored to each client.

Advanced Wealth Optimization

Identify what a client needs to reach their financial goals and the optimal investment mix to maximize their chances of success.

Optimal Risk

Alignment

Determine the lowest level of risk a client requires and the maximum they can handle. Find the ideal balance or explore potential opportunities.

A Recognized Leader in Goals-Based Investing

Nebo Wealth has been refined over a decade within a leading global investment firm (GMO) and has been honored with multiple awards for innovation since launching to advisory firms in 2022.

Empowering Advisors with Proven Benefits

We recently surveyed our advisor community to understand how Nebo is helping them.

We’re both proud of the impact and motivated to keep improving.

94%

Improves Quality of Advice

100%

Boosts Confidence in Investment Process

88%

Positions Firm for Growth

85%

Greater Client Confidence

87%

Builds Greater Trust with Clients

83%

Improves Investment Outcomes

Results based on survey of existing Nebo Wealth users in January 2025. More than half of our users participated in this survey, providing insights based on their real-world experience with Nebo.

Earning Industry Praise for Innovation

“Nebo Wealth provides advisory firms with the holy grail of portfolio management.”

Bob Veres

Inside Information, March 2024

“Nebo offers a demonstrably superior approach to portfolio optimization.”

Bill Whitt

Datos Insights: The Future of Goals-Based Investing, May 2024

“I found it to be one of the best platforms for financial advisors I have ever seen.”

Michael Edesess

Advisor Perspectives, December 2022

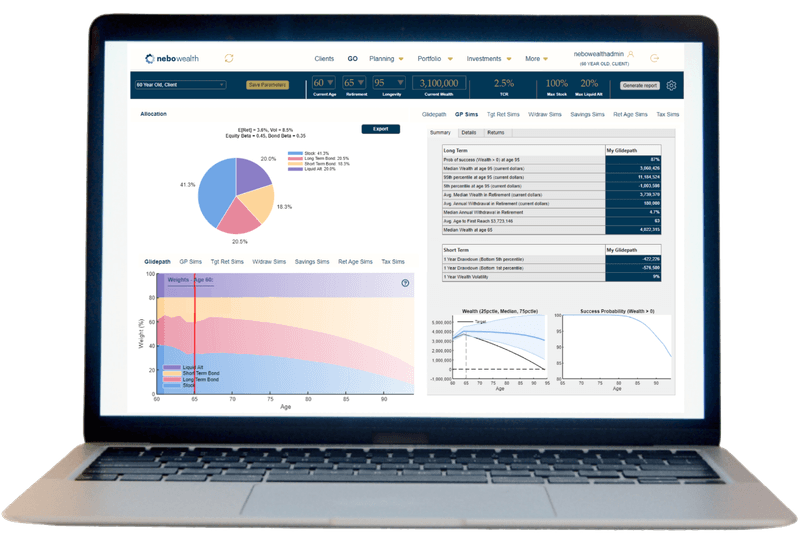

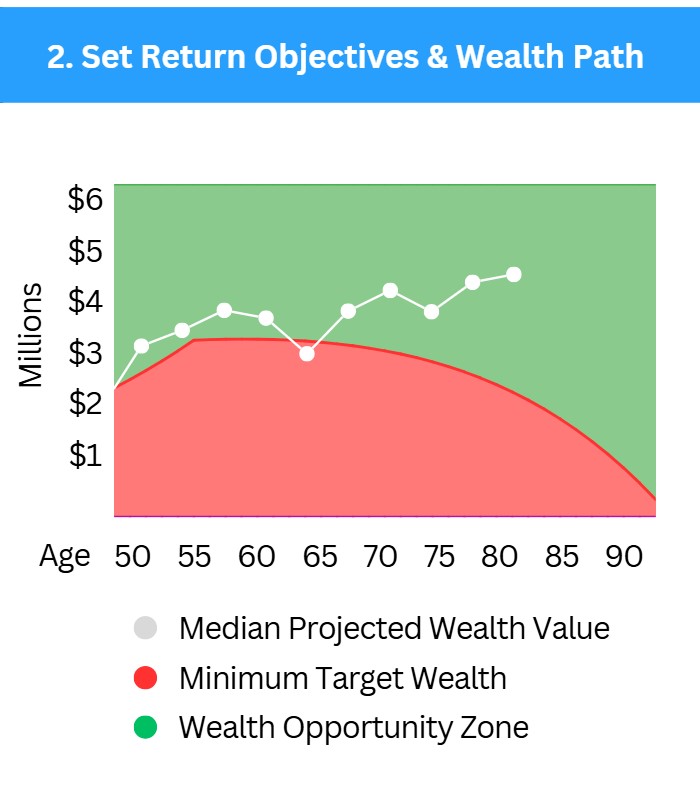

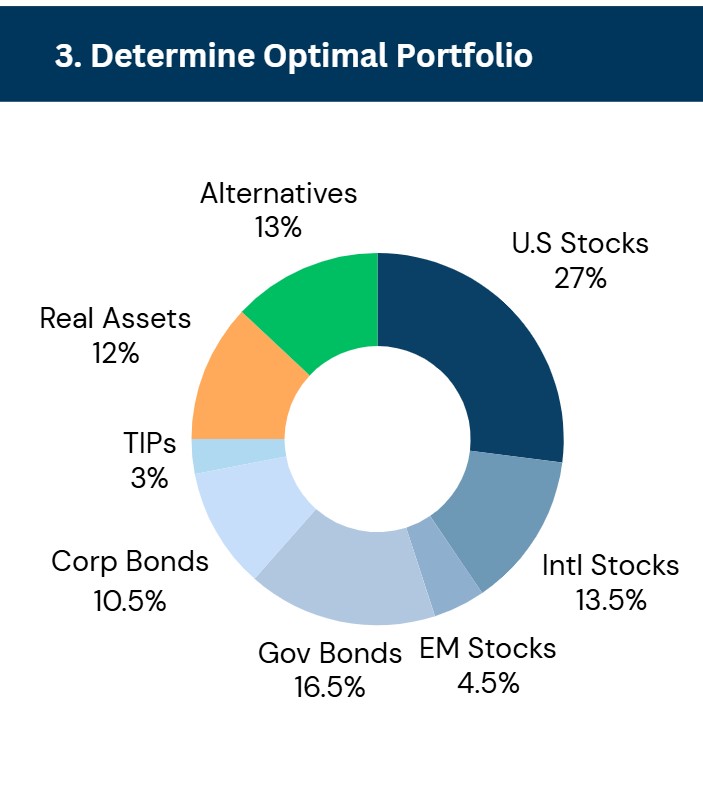

The Perfect-Fit Portfolio for Every Client

Our goal-driven investment policy process delivers fully customized solutions to help ensure clients have the wealth they need at every stage of their financial journey.

For Illustration Purposes Only. Not all asset classes represented in the portfolio allocation may be appropriate for all investors.

Offer Investment Solutions That Truly Align with Clients’ Financial Plans

As a dedicated financial advisor, your clients depend on your expertise for comprehensive financial and cash flow planning. Shouldn’t their investment portfolios mirror that same dedication and align perfectly with their unique goals, fostering greater confidence and trust in their financial future?

Trusted by Leading Advisors

Heximer Investment Management

Brandon Kremer

Portfolio Manager

“Before Nebo, we customized client portfolios around five proprietary model allocations. Now, we can deliver over 100 unique, personalized client model portfolios, truly elevating our clients’ experience, without taking any more of our team’s time or resources.”

Explore Some of Our Popular Articles

The Future of Goals-Based Investing:

An Award-Winning Four-Step Process to Improve Investor Outcomes

The Paradox of Choice in Model Marketplaces:

Why More Options Are Making it Harder for Advisors to Deliver Better Outcomes

The Perils of Outsourcing Asset Allocation to a Risk Score

Addressing Compliance Risk: Why is This Client in this Portfolio?

Grow and scale in a more efficient and compliant manner

Featured in leading industry publications

Ready to see the platform in action?

Most advisors who explore our tools find that seeing them in action makes all the difference. Click on the link below to schedule a brief exploratory call and interactive demo and take the first step to a more personalized, goals-driven investment process.